"Lighting Up Your Dark Data" by Lance Ransom

Talk by Lance Ransom, a Product Manager at Continuum Analytics and a former Partner and CTO of Schonfeld Group. From QuantCon NYC 2016.

Quants are faced with a complex data environment. Data is everywhere and it's increasingly challenging to analyze, explore and evaluate, all in one language and...

Talk by Lance Ransom, a Product Manager at Continuum Analytics and a former Partner and CTO of Schonfeld Group. From QuantCon NYC 2016.

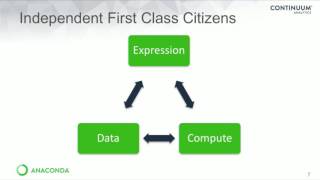

Quants are faced with a complex data environment. Data is everywhere and it's increasingly challenging to analyze, explore and evaluate, all in one language and in one environment. Quants need a unified environment where they are able to write expressions and conduct pushdown processes, all without having to move the data and having the ability to deploy anywhere, anytime. Organizations need to better marshal the data and have visibility to conduct a clean transformation. This session will discuss how businesses gain a better understanding of their data, leading to better results. In the FinServ industry, fluidity in understanding the data will help create better risk models and trading strategies. Ransom will discuss how organizations address these challenges and future proof their work.

The slides for this presentation can be found at https://www.slideshare.net/Quantopian/light-up-your-dark-data-by-lance-ransom-at-quantcon-2016.

To learn more about Quantopian, visit us at https://www.quantopian.com.

Disclaimer

Quantopian provides this presentation to help people write trading algorithms - it is not intended to provide investment advice.

More specifically, the material is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory or other services by Quantopian.

In addition, the content neither constitutes investment advice nor offers any opinion with respect to the suitability of any security or any specific investment. Quantopian makes no guarantees as to accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances.

#finance #quantitative finance #risk #risk analysis #math #statistics #algorithms #algorithmic trading

Talk by Lance Ransom, a Product Manager at Continuum Analytics and a former Partner and CTO of Schonfeld Group. From QuantCon NYC 2016.

Quants are faced with a complex data environment. Data is everywhere and it's increasingly challenging to analyze, explore and evaluate, all in one language and...

Quants are faced with a complex data environment. Data is everywhere and it's increasingly challenging to analyze, explore and evaluate, all in one language and...

Talk by Lance Ransom, a Product Manager at Continuum Analytics and a former Partner and CTO of Schonfeld Group. From QuantCon NYC 2016.

Quants are faced with a complex data environment. Data is everywhere and it's increasingly challenging to analyze, explore and evaluate, all in one language and in one environment. Quants need a unified environment where they are able to write expressions and conduct pushdown processes, all without having to move the data and having the ability to deploy anywhere, anytime. Organizations need to better marshal the data and have visibility to conduct a clean transformation. This session will discuss how businesses gain a better understanding of their data, leading to better results. In the FinServ industry, fluidity in understanding the data will help create better risk models and trading strategies. Ransom will discuss how organizations address these challenges and future proof their work.

The slides for this presentation can be found at https://www.slideshare.net/Quantopian/light-up-your-dark-data-by-lance-ransom-at-quantcon-2016.

To learn more about Quantopian, visit us at https://www.quantopian.com.

Disclaimer

Quantopian provides this presentation to help people write trading algorithms - it is not intended to provide investment advice.

More specifically, the material is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory or other services by Quantopian.

In addition, the content neither constitutes investment advice nor offers any opinion with respect to the suitability of any security or any specific investment. Quantopian makes no guarantees as to accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances.

#finance #quantitative finance #risk #risk analysis #math #statistics #algorithms #algorithmic trading

Quants are faced with a complex data environment. Data is everywhere and it's increasingly challenging to analyze, explore and evaluate, all in one language and in one environment. Quants need a unified environment where they are able to write expressions and conduct pushdown processes, all without having to move the data and having the ability to deploy anywhere, anytime. Organizations need to better marshal the data and have visibility to conduct a clean transformation. This session will discuss how businesses gain a better understanding of their data, leading to better results. In the FinServ industry, fluidity in understanding the data will help create better risk models and trading strategies. Ransom will discuss how organizations address these challenges and future proof their work.

The slides for this presentation can be found at https://www.slideshare.net/Quantopian/light-up-your-dark-data-by-lance-ransom-at-quantcon-2016.

To learn more about Quantopian, visit us at https://www.quantopian.com.

Disclaimer

Quantopian provides this presentation to help people write trading algorithms - it is not intended to provide investment advice.

More specifically, the material is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory or other services by Quantopian.

In addition, the content neither constitutes investment advice nor offers any opinion with respect to the suitability of any security or any specific investment. Quantopian makes no guarantees as to accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances.

#finance #quantitative finance #risk #risk analysis #math #statistics #algorithms #algorithmic trading

Quantopian

※本サイトに掲載されているチャンネル情報や動画情報はYouTube公式のAPIを使って取得・表示しています。

Timetable

動画タイムテーブル